With the lack of fresh market leads, overall Malaysian market sentiment is likely to drift aimlessly in a directionless market.

SHARE prices on Bursa Malaysia continued to consolidate in rangebound trading throughout the five trading days of the week. The FTSE Bursa Malaysia Composite Index (FBM KLCI) continued to stay above its critical support of 1,100 points when it closed at 1,174.27 yesterday.

The FBM KLCI opened higher at 1,168.96 before rebounding to close at its intra-day high of 1,174.49 on Monday, giving a day-on-day gain of 10.70 points, or 0.92 per cent.

Overall market sentiment moved counter-trend to the regional stock markets on Tuesday. The FBM KLCI fell from its intra-day high of 1,174.58 before slipping to its intra-day low of 1,168.99 that day. It closed at 1,171.09, giving a day-on-day loss of 3.40 points, or 0.29 per cent.

The FBM KLCI moved sideways in step with the performances on the regional stock markets on Wednesday. The benchmark index closed at 1,172.56, giving a day-on-day gain of 1.47 points, or 0.13 per cent.

Once again, share prices on Bursa Malaysia moved counter-trend to the performances on the regional stock markets on Thursday. The FBM KLCI closed at 1,176.90, giving a day-on-day gain of 4.34 points, or 0.37 per cent.

Share prices on Bursa Malaysia paused for sideways consolidations yesterday. The FBM KLCI closed at 1,174.27, giving a day-on-day loss of 2.63 point, or 0.22 per cent.

The FBM KLCI posted a week-on-week gain of 10.48 points, or 0.90 per cent.Among other indices, the FTSE Bursa Malaysia Small Cap Index eased 34.19 points, or 0.35 per cent, to 9,812.20 while the FTSE Bursa Malaysia ACE Index lost 60.31 points, or 1.43 per cent, to 4,145.53.

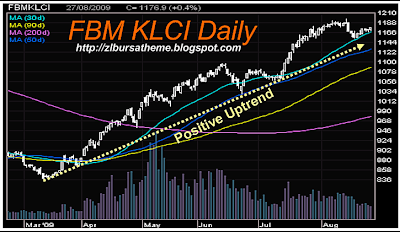

The following are the readings of some of the FBM KLCI's technical indicators:Moving Averages: The FBM KLCI continued to stay above its 10-, 20-, 30-, 50-, 100- and 200-day moving averages.

Momentum Index: Its short-term momentum index continued to stay below the support of its neutral reference line.

On Balance Volume (OBV): Its short-term OBV trend continued to stay below the support of its 10-day exponential moving averages.

Relative Strength Index (RSI): Its 14-day RSI stood at the 58.77 per cent level yesterday.

Outlook

OutlookContinuing mild technical rebounds sent the FBM KLCI to its intra-day high of 1,178.77 yesterday, moving within the confines of this column's envisaged support zone (1,167 to 1,200 levels).

The FBM KLCI's weekly chart continued to stay above its immediate downside support (See FBM KLCI's weekly chart A5:A6) yesterday. It continued to stay above its resistance-turned-support trendline (A3:A4).

Chartwise, the FBM KLCI's daily trend continued to stay above its downside support (See FBM KLCI's daily chart B1:B2) yesterday. It continued to stay below its intermediate-term uptrend (B5:B6).

The FBM KLCI's weekly and monthly fast Moving Average Convergence Divergence (MACD) indicators stayed above their respective slow MACDs yesterday. Its daily fast MACD stayed below its daily slow MACD.

The FBM KLCI's 14-day RSI stayed at 58.77 per cent level yesterday. Its 14-week and 14-month RSI stayed at 71.03 and 57.64 per cent levels respectively.

Last week, we commented that the FBM KLCI would move into rangebound trading over next the five trading days. It did. The FBM KLCI's weekly trading range shrank to 11 points.

With the lack of fresh market leads, overall market sentiment is likely to drift aimlessly in a directionless market. Heavy-weight index-linked counters will continue to play pivotal roles in maintaining the market momentum.

Next week, the FBM KLCI's envisaged resistance zone hovers at the 1,178 to 1,212 levels while its immediate downside support is at the 1,136 to 1,170 levels.

November 2009 and December 2009 were the most active contracts throughout the week.

November 2009 and December 2009 were the most active contracts throughout the week.

.jpg)

.jpg)

.jpg)

.jpg)

Harga MSM dijangka berkisar sekitar antara paras sokongan RM2,350 setan metrik dan halangan pada RM2,400 setan metrik, kata salah seorang peniaga itu.

Harga MSM dijangka berkisar sekitar antara paras sokongan RM2,350 setan metrik dan halangan pada RM2,400 setan metrik, kata salah seorang peniaga itu. Kontrak Ogos 2009 turun 2.0 mata kepada 1,169.0 sementara September 2009 dan Disember 2009 masing-masing jatuh 2.5 mata kepada 1,168.0 dan 1,163.5. Mac 2010 jatuh 3.5 mata kepada 1,157.5.

Kontrak Ogos 2009 turun 2.0 mata kepada 1,169.0 sementara September 2009 dan Disember 2009 masing-masing jatuh 2.5 mata kepada 1,168.0 dan 1,163.5. Mac 2010 jatuh 3.5 mata kepada 1,157.5.