The FCPO active month contract ended sharply higher on Thursday, due to electronic soybean oil prices traded higher which had boosted the local market sentiment. At the close, the FCPO price had added 49 pts to 2,479.

Based on the daily chart, a long positive candle had formed on Thursday where it indicated that buyers were aggressive throughout the day. During the trading sessions, the FCPO price went up to as high as 2,484 where the upside gap nearly covered. As we can see in the chart, the trend is positive as it building up higher high and to rise further, it need to break above the psychological level of 2,500.

Referring to the MACD histogram, a rounding top is forming up. As always, intraday support and resistance levels will be eyed.

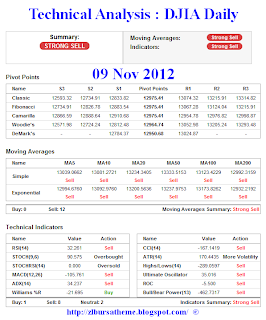

Technical indicators

MACD= Positive, ADX= Positive,

Intraday Technical Support & Resistance for 28th Dec 2012

1st support 2,420; 2nd support 2,380-50

1st resistance 2,490; 2nd resistance 2,550-70

GOODLUCK

+24+Dec+2012.png)