generally mixed on Tuesday, July 7, as investors continue to worry over the strength of the US economic recovery after last week’s dismal unemployment numbers.

generally mixed on Tuesday, July 7, as investors continue to worry over the strength of the US economic recovery after last week’s dismal unemployment numbers.The US unemployment rate hit a 26-year high of 9.5% in June, raising fears that the road to recovery will be protracted and bumpy. Consumers also continue to build up their savings to repair battered balance sheets. Consumer spending accounts for 70% of the US economy.

Mild overnight gains on Wall Street did little to assuage sentiment. The Dow Jones Industrials Average index closed 0.5% higher, mostly in late trading after being in the red for much of the day. Apart from the weak jobs report, investors are looking ahead to the upcoming earnings season for clues as to the health of the US corporate sector, particularly the banks.

Sentiment for equities was perhaps a little boosted by a plunge in crude oil prices as traders reduced demand expectations given the patchy recovery ahead.

Crude oil prices have fallen to a five-week low of below US$64 per barrel, from a year high of US$73.50 just last week. This in turn caused crude palm oil prices to slide to under RM2,100 per tonne on Tuesday, from a recent high of around RM2,800 per tonne.

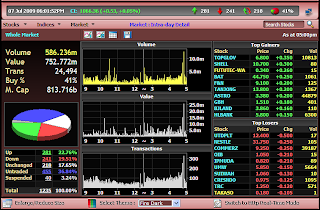

Crude oil prices have fallen to a five-week low of below US$64 per barrel, from a year high of US$73.50 just last week. This in turn caused crude palm oil prices to slide to under RM2,100 per tonne on Tuesday, from a recent high of around RM2,800 per tonne.On Tuesday, the FBM KLCI traded within a very narrow range for much of the day, with volume thinning out considerably as investors turned cautious. The index ended just 0.5 of a point higher at 1,066.4. Market breadth was mixed with an almost equal number of advancing and declining stocks.

Volume was very thin at just 586 million shares, compared with 763 million shares on Monday and last week’s daily average of 999 million shares.

Volume was very thin at just 586 million shares, compared with 763 million shares on Monday and last week’s daily average of 999 million shares.The most actively traded stocks include KNM, Talam, UEM Land, Time, Dreamgate, Axiata and Tebrau. Major gainers include Top Glove, Shell, BAT and Tanjong plc. Losers include Bumiputra-Commerce and UMW.

Our KLCI index changed name right? Is it change to FMB-KLCI?

ReplyDeleteCorrect >>> FBM KLCI started on Monday 05/7/09

ReplyDeleteTQVM 4ur enquiries

ZL