FBM KLCI 30/09/2010

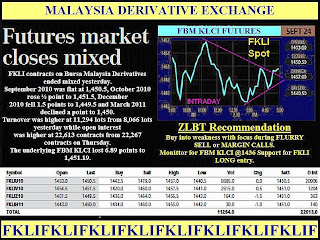

FBM KLCI 30/09/2010 As indicated by A, the FBM KLCI rose 1.72 points to close at 1463.50 points. Generally, the KLCI is still consolidating with the over head resistance at 1479.59 while the supports are found at 1436 followed by 1424 WinChart Automatic Fibonacci Retracement.

As shown on the chart above, the Bollinger Bands contracted 5%, suggest that the KLCI is indeed consolidating, while also preparing for a new movement. The market direction is likely to be uncertain, until the re-expansion of the Bollinger Bands, then the new direction would be determined by the position of the KLCI above or below the Bollinger Middle Band.

As indicated by B, total market volume increased 16.2%, with volume still above the 40-day VMA level. Generally, the market sentiment as a whole is still on the positive if volume could maintain firmly above the 40-day VMA level.

As indicated by C, the MACD histogram fell below the zero level, suggesting that the MACD line has crossed below the trigger line. This is a signal suggest a weakening movement for the KLCI, and the weakening of the KLCI is expected to carry on until the MACD histogram should form a Rounding Bottom.

As indicated by C, the MACD histogram fell below the zero level, suggesting that the MACD line has crossed below the trigger line. This is a signal suggest a weakening movement for the KLCI, and the weakening of the KLCI is expected to carry on until the MACD histogram should form a Rounding Bottom.The KLCI is consolidating with positive technical outlook, as the KLCI uptrend is unaffected, with the 14, 21, 31 EMA still supporting the KLCI. Nevertheless, whether or not the KLCI could resume its uptrend rally, we shall later decide with a clearer Bollinger Bands signal.

如图中箭头A所示,富时综合指数微扬1.72点,以1463.50点闭市,这显示综指继续的横摆巩固,综指当前的阻力依然是1479.59点的费氏线,支持水平则是落在1436点及1424点的费氏线。

如图所示,布林频带(Bollinger Bands)收窄5%,这显示综指目前正处于横摆巩固,直到布林频带重新打开为止。这也意味着综指正在酝酿着一个新的趋势,综指的新趋势将取决于综指处于布林中频带(Bollinger Middle Band)的相应位置。

如图中箭头B所示,马股的成交量增加16.2%,所以成交量得以保持在40天成交量移动平均线(VMA)以上,这显示市场的交投继续活跃,这对增加市场的承接力量是有帮助的。若市场的承接力量继续增加,换句话说,更多的买盘流入,那综指将有望在套利卖压被完全吸纳后重新获得上扬的机会。

如图中箭头B所示,马股的成交量增加16.2%,所以成交量得以保持在40天成交量移动平均线(VMA)以上,这显示市场的交投继续活跃,这对增加市场的承接力量是有帮助的。若市场的承接力量继续增加,换句话说,更多的买盘流入,那综指将有望在套利卖压被完全吸纳后重新获得上扬的机会。 如图中箭头C所示,平均乖离的振荡指标(MACD Histogram)虽然已处于零轴以下,不过振荡指标下滑的速度有减低的迹象,所以接下来若振荡指标形成一个圆底(Rounding Bottom)的话,综指的短期走势将有望开始上扬。

综指继续的保持横摆巩固的走势,目前综指处于布林中频带的水平,所以综指的后市仍然未明朗化。以技术而言,综指将继续保持目前的走势,直到布林频带明显的打开为止,届时综指的新走势将是综指处于布林中频带的方向。

OK OK Stop twisting my arm

ZL looking for a technical rebound when FBMKLCI is within

1436 >>> 1440 zone

HAPPY TRADING

Crude futures continued their trek higher last Friday, as a surprise rise in Germany's Ifo index of business sentiment weighed heavily on the U.S. dollar.

Crude futures continued their trek higher last Friday, as a surprise rise in Germany's Ifo index of business sentiment weighed heavily on the U.S. dollar.

Therefore, despite the substantial bullish move that occurred last week, the fact that price has tentatively respected this resistance confluence with a bearish bounce indicates that the pair is technically still within the confines of a longer-term downtrend. Whether this downtrend continues or not is largely dependent upon whether price breaks down further to breach 85.00 significantly. If this becomes the case, price could potentially go on to target the support lows around 83.00 once again. In the event of a strong subsequent upside breach of the noted 86.00 resistance, a key further resistance target resides around the important 88.00 price region.

Therefore, despite the substantial bullish move that occurred last week, the fact that price has tentatively respected this resistance confluence with a bearish bounce indicates that the pair is technically still within the confines of a longer-term downtrend. Whether this downtrend continues or not is largely dependent upon whether price breaks down further to breach 85.00 significantly. If this becomes the case, price could potentially go on to target the support lows around 83.00 once again. In the event of a strong subsequent upside breach of the noted 86.00 resistance, a key further resistance target resides around the important 88.00 price region.