The headlines last week seemed to suggest high drama in the market, as traders responded to the threat of a shutdown by the U.S. government, another earthquake for disaster-stricken Japan, and a flurry of monetary policy maneuvers from central banks around the globe. However, the major market indexes settled the week right where they started -- namely, on the wrong side of psychologically critical technical levels. As we stand on the cusp of both options expiration and a brand-new season of corporate earnings reports, We offers a few points to ponder about the level of engagement among hedge funds and retail level investors.

Following our train of thought, lets attempts to resolve conflicting signals from investor sentiment and technical flows.as well as a preview of the week ahead -- which includes a healthy dose of inflation data, along with earnings announcements from the likes of Alcoa and Bank of America.

"For the Dow and other major market indexes, important resistance levels lie just overhead that could impact short-term trading patterns. The good news for bulls -- as we have discussed in previous weeks -- is that the sentiment backdrop is one that suggests there is still firepower on the sidelines to drive equities through these critical overhead levels..."

A rate hike by the European Central Bank (its first since 2008, and very much expected), another rate hike by the Chinese (which investors have grown to expect), domestic retail sales numbers that were generally well-received, and the prospect of a U.S. government shutdown amid partisan budget disagreements were the major headlines last week. While there was a lot to read and write about, equities did very little on a net basis during the week, with major technical resistance levels coming into play -- as anticipated.

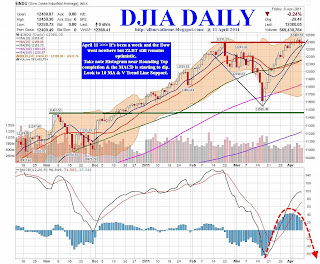

For example, the Dow Jones Industrial Average (DJIA - 12,380.05) below made a brief move above its February high in the 12,400 area, but closed the week below this round-number level.

The S&P 500 Index (SPX - 1,328.17) ventured above its March 2009 double-low in the 1,333 area, but a sustained move through this level continues to elude the index, which closed the week below 1,333 once again. In fact, there has been only one weekly close above 1,333 this year, which occurred in mid-February.

So it's quite clear that overhead technical levels are having a stifling impact at present, as the Dow and other indexes contend with everything from "double-top" to "double-low" to "round-number" resistance areas simultaneously.

In addition to revealing the market's reaction to the narrowly averted government shutdown, Monday also marks the unofficial start of earnings season, with Alcoa's (AA) first-quarter report due out after the closing bell. Moreover, since the first Friday of the month was on April 1, expiration week is upon us already, and trading will also be impacted by the expiration of equity and index options.

The good news for bulls as we enter earnings season is that expectations appear to be low. An article in a popular financial publication captured the sentiment heading into the earnings season by pointing out that "investors will be scouring for signs of margin damage," and went on to note the unusually high number of downward revisions in earnings estimates. We'll begin to see the full impact of these reports into the last week of April and the beginning of May, as this time period is really the "heart" of earnings season, given the larger number of companies reporting.

The good news for bulls as we enter earnings season is that expectations appear to be low. An article in a popular financial publication captured the sentiment heading into the earnings season by pointing out that "investors will be scouring for signs of margin damage," and went on to note the unusually high number of downward revisions in earnings estimates. We'll begin to see the full impact of these reports into the last week of April and the beginning of May, as this time period is really the "heart" of earnings season, given the larger number of companies reporting.While the market continues to be challenged by overhead technical resistance in the short term, which could results in sideways action or a modest pullback we remain somewhat encouraged by the potential sideline cash that could drive equities through resistance.

This Week's Key Events: Alcoa Kicks Off First-Quarter Earnings Reports

Here is a brief list of some of the key events this week. All earnings dates listed below are tentative and subject to change. Please check with each company's respective website for official reporting dates.

Monday

There are no major economic reports slated for Monday, but Chicago Fed President Charles Evans is scheduled to speak at the Annual Risk Conference. Earnings season unofficially begins with the release of Alcoa's (AA) first-quarter results after the close.

Tuesday

Tuesday brings us the February trade balance, as well as import/export prices and the Treasury budget for March. Fastenal (FAST) is scheduled to report earnings.

Wednesday

The Fed's Beige Book report for April is due out Wednesday, along with February's business inventories and the regularly scheduled update on crude inventories. On the earnings front, we'll hear from ASML Holding (ASML) and JPMorgan Chase (JPM).

Thursday

As usual, weekly jobless claims are scheduled to hit the Street on Thursday. Inflation data also starts to roll in, with the release of the producer price index (PPI) and core PPI for March. Hasbro (HAS), Progressive (PGR), and Google (GOOG) are expected to report earnings.

Friday

The week wraps up with a flurry of economic data, including industrial production, capacity utilization, the consumer price index (CPI) and core CPI for March, the preliminary April Reuters/University of Michigan sentiment survey, and the Empire State manufacturing index for April. There are also a few notable earnings announcements on the calendar, with quarterly reports due out from Bank of America (BAC), Mattel (MAT), and Infosys (INFY).

TECHNICAL ANALYSIS

Dow Jones Industrial Average

The Dow closed lower due to profit taking on Friday as it consolidates some of the rally off March's low. Stochastics and the RSI are overbought but remain neutral to bullish signaling that sideways to higher prices are possible near-term. If the Dow extends the aforementioned rally, weekly resistance crossing at 12,767 is the next upside target. Closes below the 20-day moving average crossing at 12,157 are needed to confirm that a short-term top has been posted.

First resistance is today's high crossing at 12,450. Second resistance is weekly resistance crossing at 12,767. First support is the 10-day moving average crossing at 12,353. Second support is the 20-day moving average crossing at 12,157.

HAPPY TRADING & GOODLUCK2ALL

No comments:

Post a Comment