The FTSE Bursa Malaysia Composite Index (FBM KLCI) continued to stay above its major psychological support of 1,200 points when it closed at 1,206.25 yesterday.

The FTSE Bursa Malaysia Composite Index (FBM KLCI) continued to stay above its major psychological support of 1,200 points when it closed at 1,206.25 yesterday.A sharp technical pullback on Wall Street overnight sent regional stock markets into a tailspin yesterday. The FBM KLCI closed at 1,206.25, giving a day-on-day loss of 2.10 points, or 0.17 per cent. The FBM KLCI posted a week-on-week loss of 11.14 points, or 0.92 per cent.

The following are the readings of some of its technical indicators:

*Moving Averages: The FBM KLCI continued to stay above its 30-, 50-, 100- and 200-day moving averages. It had since stayed below the support of its 10- and 20-day moving averages

*Momentum Index: Its short-term momentum index stayed below the support of its neutral reference line.

*On Balance Volume: Its short-term OBV trend stayed below the support of its 10-day exponential moving averages.

*Relative Strength Index: Its 14-day RSI stood at the 56.90 per cent level yesterday.

The FBM KLCI's continued consolidation saw it hitting an intra-week low of 1,200.65 on Wednesday, staging a re-test of this column's envisaged support zone (1,180 to 1,214 levels).

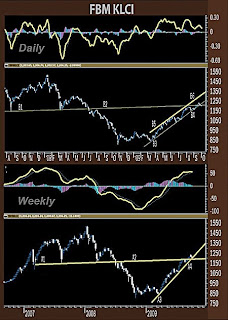

The FBM KLCI's weekly chart continued to stay precariously above the support of its intermediate-term uptrend support (see FBM KLCI's weekly chart A3:A4) at the market close yesterday. It continued to stay above the neckline (A1:A2) of its head-and-shoulders pattern formation.

Chartwise, the FBM KLCI's daily trend had since breached the lower support (see FBM KLCI's daily chart B3:B4) of its intermediate-term uptrend channel (B3:B4 and B5:B6) yesterday.

Also, the FBM KLCI breached the support of its immediate overhead resistance (B1:B2). The index's weekly and monthly fast Moving Average Convergence Divergence indicators (MACDs) stayed above their respective slow MACDs yesterday. Its daily fast MACD staged a "dead cross" of its daily slow MACD on Monday.The FBM KLCI's 14-day RSI stayed at 56.90 per cent level yesterday.

Its 14-week and 14-month RSI stayed at 71.29 and 59.82 per cent levels respectively.

Last week, this column commented that due to the lack of fresh market leads and dwindling market volume, the FBM KLCI was likely to consolidate further to stage a re-test of its immediate downside support of 1,210. The FBM KLCI traced out a week-on-week loss of 11.14 points.

Once again, overall market sentiment is not likely to pick up during the first part of next week. Thus, further consolidation is on the cards and the FBM KLCI is likely to stage a re-test of its support at 1,200. Buying support may emerge in the later part of the week in its preparation for the pre-Budget rally.

Next week, the FBM KLCI's envisaged resistance zone hovers at the 1,210 to 1,244 levels while its immediate downside support is at the 1,168 to 1,202 levels.

No comments:

Post a Comment