You won't see this anywhere outside of BT

Please click images to ENLARGE

The bulls explored the black for most of the session today, with encouraging assessments of the housing and industrial sectors, an upbeat economic forecast from the central bank, and a handful of strong earnings reports combining to keep the bulls on top.

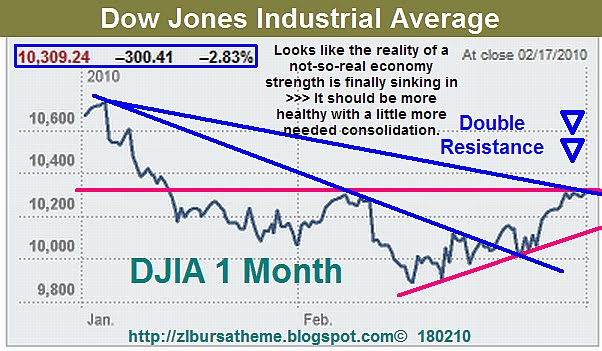

The Dow Jones Industrial Average (DJIA – 10,309.24) advanced 40.4 points, or 0.4%, today, settling atop the 10,300 level for the first time since Jan. 21.

The Dow Jones Industrial Average (DJIA – 10,309.24) advanced 40.4 points, or 0.4%, today, settling atop the 10,300 level for the first time since Jan. 21.

Despite the blue-chip barometer's upward trajectory of late, the index is still battling its 10-week trendline, which hasn't been defeated on a weekly closing basis in more than four weeks. 5 Days Dow Recouped 270.86 points (+2.70%)

5 Days Dow Recouped 270.86 points (+2.70%)

5 Days Dow Recouped 270.86 points (+2.70%)

5 Days Dow Recouped 270.86 points (+2.70%)This is the most noticeable gains over 5 days since mid January 2010

A flash in the pan or a rebound waiting to be canned?

Marauding bears terrorised Wall Streets recently with the bulls beating a massive retreat and reacting defensively only about the last week or so.

Even with some damage control, the Dow still bled more than 300 pts over the last 30 bloody days from the sudden scathing attack. The injured are still trickling in .....

A Rousing Performance Over The Past Twelve Months

A Rousing Performance Over The Past Twelve MonthsBut the victory has taken it's toll and the bulls need to hunker down & regroup before any further advancement can be considered. The bears sensed this ........

The stale bulls need a recharge for another push uphill. Time to set up base camp around the 10K level.

Stay alert for any incoming. You bet the bears will be lobbing a few bombs from higher grounds.

This is gonna be another long hard climb ahead.

NOTE: ZL have an uncanny feeling the bears are still around and amassing for another go at the bulls.

No comments:

Post a Comment