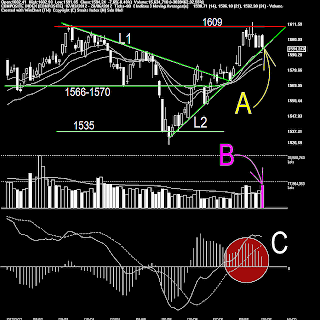

As indicated by A, the FBM KLCI retreated and precisely testing the L2 uptrend line and the 14, 21, 31 EMA dynamic support. The KLCI fell 7.65 points or 0.48% to close at 1594.24 points. Resistance for the KLCI remains at 1609-1611.

As indicated by B, total market volume increased 32.55%. Part of the reason was the active trading of Felda Global Venture Holding Bhd, which has accounted a little more than 16% of the total market volume. Nevertheless, with losers outnumbered gainers (477 to 248), the increased of volume actually suggests some increased of selling pressure.

As circled at C, the MACD histogram is still falling, thus no Rounding Bottom signal is sighted yet. The falling of the MACD histogram suggests that the KLCI is still losing strength or it is still consolidating.

In conclusion, the FBM KLCI is testing its L2 uptrend line. If the KLCI should break below this L2 line, it means that the L2 uptrend would be temporary interrupted. However, a break below the L2 does not necessary means an immediate bearish reversal, at least not until the KLCI has formed lower-highs. On the other hand, if the KLCI could rebound from the L2 line or the 14, 21, 31 EMA, and forms Higher-Lows, it means that the current uptrend is still intact.

富时大马综合指数 2012-06-28

如图中箭头A所示,富时大马综合指数周四下调,精确的试探L2上升趋势线及14、21、31天EMA的动态支持线。综指按日下跌7.65点或0.48%,以1594.24点挂收。综指阻力维持在1609-1611点的水平。

如图中箭头B所示,马股总成交量增加32.55%。马股周四成交量明显增加的其中原因之一是联邦土地发展局环球创投控股(FGV)上市首日的活跃交易(高达总成交量的16%)所致。无论如何,由于周四马股下跌股项有477只,上升股项仅有248只,因此成交量的增加也暗示着投资者套利活动也相当的活跃。一般来说,若马股下跌时成交量明显增加的话,往往表示卖压的增加。

如图中C圈所示,平均乖离振荡指标(MACD Histogram)继续的下滑,因此还未有形成圆底(Rounding Bottom)的迹象。这表示综指短期还未能摆脱盘整格局。

总的来所,综指目前在试探L2的上升趋势线。若综指继续下调而跌破此线的话,那表示L2的上升趋势线暂时将受到中断。但是综指跌破L2线或14、21、31天EMA动态支持线并不表示综指将立即转弱形成跌势,除非随后再出现较低峰(Lower-highs)的特征,届时才有形成跌势的先兆。相反地,若综指能在L2线或14、21、31天EMA上反弹而形成较高底,届时表示综指目前的涨势还是完整的。

祝你好运

No comments:

Post a Comment